Blog · Approx. 2 minute read

How Can TreviPay Help Me as CFO?

Part 3 of our 3-part series about How TreviPay Can Help. (Part 1, Part 2)

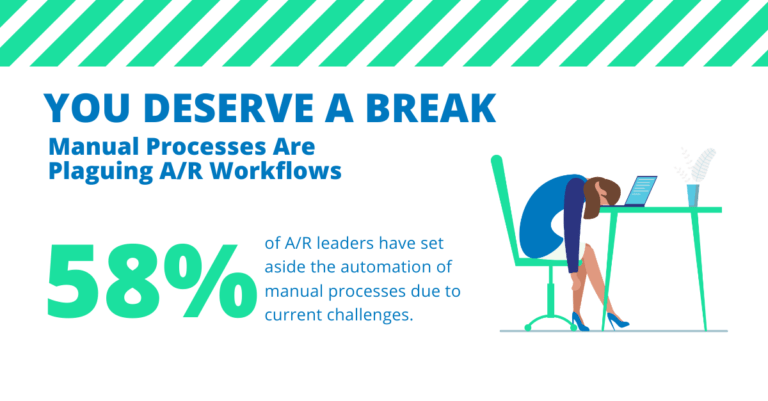

Reducing costs and improving cash flow is likely music to your ears. But it’s not easy to do when you have several hands dipping into your working capital or have credit card fees unnecessarily cutting into your bottom-line.

You don’t have to be one of the B2B companies spending an average of $2.2 million in credit card processing fees. Whether you’re an SMB or an enterprise, you need to weigh the high credit card transaction costs against the benefits of offering credit card payment options in your eCommerce store. In addition to high fees, credit cards create challenges for buyers. Credit limits make them a problem for large purchases, and statements are difficult for AP to reconcile when it comes time to pay the bill.

Letting customers buy online with Net30 terms would help, but then you have to worry about when you are going to get paid. In 2018, balance sheets showed DSO staggered around 37 days, two days more than the previous year. A global report shows a delay in payment of up to 92 days if you’re working with suppliers in China.

When DSO is high, it drags down your liquidity and the finance team’s efficiency. In order to keep pressure on customers to pay you’d need a collections workforce increasing labor costs. If you only have a few team members able to chase payments, you’re in trouble.

Would you raise your hand if you could extend risk-free lines of business credit to your customers, reduce stress on your team and keep your working capital for your business? We would, too.

That’s why we created TreviPay. Businesses leverage TreviPay to extend white-labeled Net30 terms get paid quickly to improve cash flow and reduce costs by outsourcing billing and collections.

In short, TreviPay streamlines back-office processes, transforming the way businesses facilitate and manage purchases made on terms.

Ready to give TreviPay a try? Request a demo to see it for yourself.

While you wait, get more information in the TreviPay Tip Sheet.

Stay up-to-date with the latest from TreviPay

Thank you for subscribing! You will now receive email updates from TreviPay.